A Staggering Financial Setback

Imagine losing $29 billion in a single day—an amount surpassing the GDP of entire nations like Iceland or Madagascar, disappearing within mere hours. For most, such a loss is unimaginable, but for Elon Musk, it serves as a stark illustration of the volatility that defines billionaire wealth.

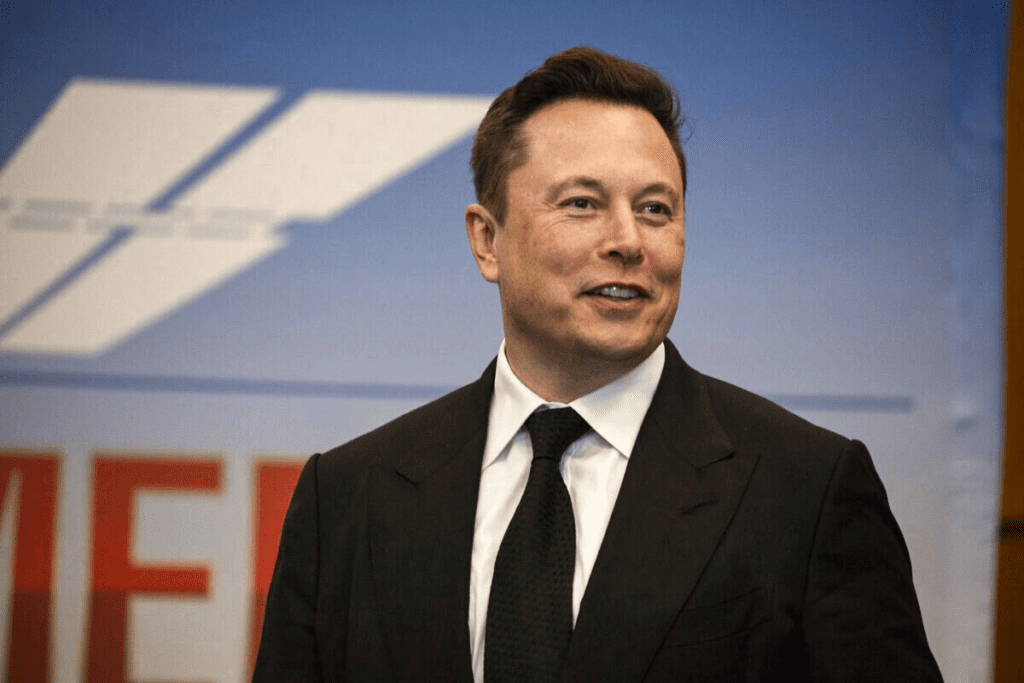

The CEO of Tesla and SpaceX, known for his ambitious ventures and unfiltered social media persona, recently experienced a significant financial blow due to a steep drop in Tesla’s stock value. While Musk remains among the world’s wealthiest individuals, the magnitude of this decline has sparked considerable discussion. What caused this substantial loss? And perhaps more intriguingly, how does Musk perceive it?

Beyond its immediate financial impact, this event raises broader questions—not only about Tesla’s trajectory but also about the unpredictability of the technology sector as a whole.

The Factors Behind the Decline

Musk’s $29 billion loss was not triggered by a single event but resulted from a confluence of factors, primarily related to Tesla’s stock performance. The automaker witnessed a significant decline in its share price, which heavily influences Musk’s net worth, given his substantial stake in the company. Unlike conventional income sources, billionaire fortunes are often at the mercy of market dynamics, shaped by economic trends, investor sentiment, and corporate developments. This time, it was Tesla’s ongoing challenges that fueled the downturn.

A major concern for investors has been the slowing demand for Tesla’s vehicles. Once the undisputed leader in the electric vehicle industry, Tesla now faces increasing competition, particularly from Chinese manufacturers such as BYD, which are rapidly gaining market share. In response, Tesla has implemented aggressive price reductions in multiple regions to sustain sales momentum. However, these discounts have sparked apprehension regarding the company’s profit margins, prompting investors to question whether Tesla’s strategy is sustainable or indicative of deeper demand concerns. Furthermore, delays in launching new models, including the much-anticipated Cybertruck, have only added to market uncertainty.

Beyond company-specific issues, broader economic factors have also played a role. The technology sector has recently experienced heightened volatility, with rising interest rates and economic uncertainty prompting greater investor caution. Higher borrowing costs pose challenges for tech companies with ambitious growth strategies, such as Tesla, by making expansion efforts more financially demanding. Additionally, regulatory scrutiny concerning Tesla’s autonomous driving technology and safety standards in multiple countries has further compounded investor concerns, adding another layer of risk to the company’s outlook.

While Tesla’s stock has endured fluctuations before, the scale of this recent decline raises critical questions: Is this merely a temporary setback in the ever-volatile world of technology stocks, or does it signal a fundamental shift in investor confidence regarding Tesla’s future? As analysts and market observers weigh in, all eyes remain on Musk’s next move.

Musk’s Response: Composed or Concerned?

Elon Musk is no stranger to financial turbulence, but even for a seasoned entrepreneur, losing $29 billion in a single day is no small event. His reaction, however, was characteristic—combining stoicism, defiance, and an air of indifference. Musk, known for dismissing setbacks with humor and bold rhetoric, once again maintained his signature approach to market fluctuations.

Following the dramatic drop in Tesla’s stock, Musk turned to his preferred communication platform, X (formerly Twitter), where his engagement with posts regarding Tesla’s performance indicated awareness of the situation. While he refrained from issuing a direct statement of concern, his past remarks suggest that he views stock price volatility as an inevitable aspect of long-term innovation. Yet, with Tesla’s valuation under increasing scrutiny, this latest financial hit may carry more significance than previous downturns.